Frequently Asked Questions

- What does findCRA do?

- What is CRA?

- What is low- and moderate-income?

- How does a bank work with findCRA?

- How does a nonprofit work with findCRA?

- Where is findCRA available?

- How does findCRA qualify nonprofits?

- How do I get started?

- How much does it cost to use?

What does findCRA do?

Founded in 2013 and headquartered in Louisville, Kentucky, findCRA provides software and consulting services for banks and nonprofits throughout the nation. All our products and services are focused on making CRA research and relationship-building easy and intuitive.

Banks utilize our services for market research and outreach efforts to meet their requirements under the federal Community Reinvestment Act. Our powerful SaaS solutions – Community Qualifier, Contexter, and ComplyAnswer – help banks streamline their success under CRA. We also offer a variety of traditional CRA consulting services, including CRA program and activities review, exam preparation, staff training and others.

Nonprofits can claim their findCRA nonprofit profile on our platform or request to be added for free. A claimed nonprofit gains access to its findCRA Nonprofit Profile, which can be used in bank outreach efforts. Nonprofits can also complete all required information on their findCRA Nonprofit Profile to become 100% CRA Verified for free, which unlocks additional tools, guides, training and marketing materials to help tell their CRA story.

What is CRA?

The Community Reinvestment Act or CRA is a federal regulation that was signed into law in 1977. It is designed to encourage banks to help meet the credit needs in all segments of the communities where they operate. The regulation arose out of discriminatory redlining practices conducted by some lenders against low-income borrowers and low-income neighborhoods.

The CRA requires banks to demonstrate sustained performance in meeting the needs of their communities. Dependent on the bank’s size, banks are evaluated in three areas. All banks are reviewed on their lending activity which can include mortgage, small business, and community development loans. Banks over a certain asset size must also show how they are meeting their communities’ needs through qualified investments and community development services.

Every insured financial institution is examined periodically by their federal regulator to measure their performance with the requirements of the CRA. After the completion of this examination, the regulator issues a CRA Rating and a CRA Public Evaluation. This rating will range between Outstanding, Satisfactory, Needs to Improve, or Substantial Noncompliance. It serves as a measure of how well the institution is meeting its communities’ needs.

To learn more about the CRA, visit our socrates CRA Knowledge Base.

To keep up-to-date with changes in the CRA industry, visit our CRA Newswire.

What is low- and moderate-income?

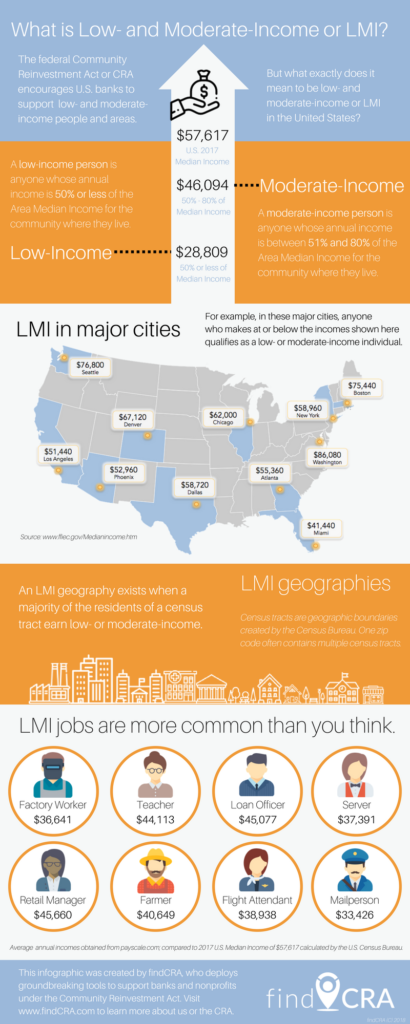

“What is low- or moderate-income or LMI?” is one of the most common questions we hear at findCRA. Most people may have a general understanding of what it means to be low-income, but under the federal Community Reinvestment Act, defining low- and moderate-income can seem overly technical and confusing. More importantly, knowing what makes up low- and moderate-income groups and communities is key to understanding the purpose of CRA and which programs and activities may qualify for CRA support.

We’ve make it simple to know exactly what it means to be low- or moderate-income, as outlined in the CRA. Read our full blog post about how to define low- and moderate-income here.

Download our helpful infographic below:

How does a bank work with findCRA?

Banks use our services for market research, compliance documentation, as well as outreach efforts to nonprofits and other community development partners, all to help meet their requirements under the federal Community Reinvestment Act.

Banks can use any of findCRA’s online, Software-as-a-Service (SaaS) solutions by purchasing a subscription for their bank. Our SaaS solutions are designed with a “CRA first” mindset to make community research and outreach easier than it’s ever been. These solutions are unique in the marketplace and include the following products:

Community Qualifier enables banks to search for CRA-aligned nonprofits in any city, state, county or zip code. Banks can view details profiles for each nonprofit and maintain those profiles as consistent records for their examiners. Banks can also request introductions to nonprofits and message nonprofits through the Community Qualifier platform.

Contexter empowers banks to build CRA performance context instantly for any county in the nation. With Contexter, a bank can review nearly 200 data points organized into 10 key areas like housing, education, income, employment, and more. Market reports can be shared, saved, and printed as needed to make performance context research instant and easy.

ComplyAnswer supports banks by allowing them to ask CRA questions as needed and receive consultant level responses without the traditional consulting proposal and engagement process.

In addition to our online solutions, we also offer a customized CRA consulting engagements for banks ranging from staff training to detailed CRA activities analysis and program review.

How does a nonprofit work with findCRA?

Nonprofits work with findCRA to educate, equip and empower their organization to build new relationships with banks in their community.

At findCRA, we developed CRANIA, our Community Reinvestment Act Nonprofit Identification Algorithm, which qualifies IRS-registered nonprofits in comparison to the requirements of the Community Reinvestment Act. Once we qualify a nonprofit, we create a findCRA Nonprofit Profile for each nonprofit and add it to our Community Qualifier platform.

Nonprofits can claim their findCRA profile for free. When a nonprofit claims it profile, it can add information about additional details to help stand out to banks. Claim your nonprofit now.

The next step is to reach 100% CRA Verified status. Any claimed nonprofit can reach this status for free by completing all required information on its findCRA Nonprofit Profile. Progress is tracked right on the user dashboard or the profile itself. Once 100% CRA Verified status is reached, the nonprofit gains access to helpful CRA tools including research guides, training, and marketing materials to promote their CRA Verified status to banks.

Where is findCRA available?

We offer our services to banks and nonprofits in all 50 states. You can learn more about our services at the following pages:

How does findCRA qualify nonprofits?

At findCRA, we created CRANIA, the Community Reinvestment Act Nonprofit Identification Algorithm. This proprietary decisioning tool aggregates data from multiple sources to qualify our nonprofits based on their aligned with CRA. We know that banks and CRA professionals rely on trusted government and industry resources to measure CRA performance. That’s why we’ve compiled key data from over 20 sources including the Internal Revenue Service (IRS), the U.S. Census Bureau, the Federal Financial Institutions Examination Council (FFIEC), the Community Development Financial Institutions Fund (CDFI Fund), the Department of Housing and Urban Development (HUD), and more.

Using these sources, we aggregate nearly 1,400 data points and incorporate key data points into our nonprofit qualification process. Each nonprofit must be registered with the IRS and be current with their tax filing requirements. Using CRANIA, we narrow the list of nonprofits down to the ones that are closely aligned with CRA.

From there, our CRA experts further curate the results. We also ensure that each nonprofit’s information is accurate to assist in a bank’s research. Only after a nonprofit passes our two-step process do we create its nonprofit profile on Community Qualifier.

Once a nonprofit has passed our review, we create a Nonprofit Profile for each CRA-aligned nonprofit on our website. Each CRA-aligned nonprofit’s profile includes dozens of key data points from the same trusted sources as well as our own analysis and reporting from the nonprofit, highlighting exactly how each is CRA-aligned.

Search for CRA-qualified nonprofits in your assessment area now.

How do I get started?

For Banks, the first step is to schedule a quick 15-minute call with our team to learn more about your bank’s needs and which of our solutions can best support your CRA goals. Schedule a call now.

For Nonprofits, start by claiming your nonprofit for free. Once you’ve claimed your nonprofit, the final step is to reach 100% CRA Verified status by completing all required information on your free profile. You can learn more about our services for nonprofits here.

How much does it cost to use?

For Banks, we customize our pricing based on your bank’s needs and the services you’d like to use. To schedule a 15-minute call to start the process or request a pricing quote, click here.

Nonprofits never have to pay to use findCRA’s online services. A nonprofit can claim its findCRA Nonprofit Profile and upgrade it to CRA Verified status for free.